Epoch Raises $1.2M for Building a Solver Coordination Layer

SINGAPORE, Sept. 15, 2025 (GLOBE NEWSWIRE) -- Epoch Protocol, the intent-solver coordination layer for Web3, has closed a $1.2 million funding round led by a number of strategic blockchain VCs including L2Iterative Ventures, Alphemy Capital, G20 Group, Longhash Ventures, SAFE and HadronFC and supported by a roster of experienced angel investors, including Anurag Arjun (Avail), Prabal Banerjee (Avail), Adrian Brink (Anoma), Matt Wright (Gaianet), Christian Narvaez (Rayo Capital), Georgi Zlatarev (Blocksense), Harsh Rajat (Push Protocol), Denver Dsouza (Devfolio) and Shubham Bhandari (Manta Network). The raise validates a simple thesis: solver coordination is the missing piece in the Web3 infrastructure stack and the glue that turns declarative user intents into safe, efficient, atomic outcomes across chains.

This capital will accelerate Epoch’s engineering work, expand ecosystem partnerships, and power a staged public testnet that onboards developers, node operators, and solver contributors. Epoch Protocol is positioning itself as the infrastructure backbone for next-generation dApps: intent → solver → outcome.

What is Epoch?

Epoch Protocol is an Intent-Solver Coordination layer that uses intents as an interaction paradigm to abstract the complexities that come with multi-chain interactions. The protocol's vision is to create a system where users can express their desired state outcome without needing to understand the underlying mechanisms of chains, protocols, gas fees, or execution paths and protocol through careful coordination, and get users there through the best rates and routes through intent abstraction.

Why this matters: Web3 is fragmented at the cost of users & developers

Today’s multi-chain world forces users and builders to handle dozens of moving parts: bridges, DEXs, chain-specific gas tokens, RPC endpoints, relayers, and custom approval flows. This fragmentation in web3 creates poor UX for users and large integration overhead for developers. A single “provide liquidity” flow can require bridging funds, managing gas on multiple chains, running approval transactions, and stitching together DEX/bridge APIs; a process that turns product work into infrastructure work.

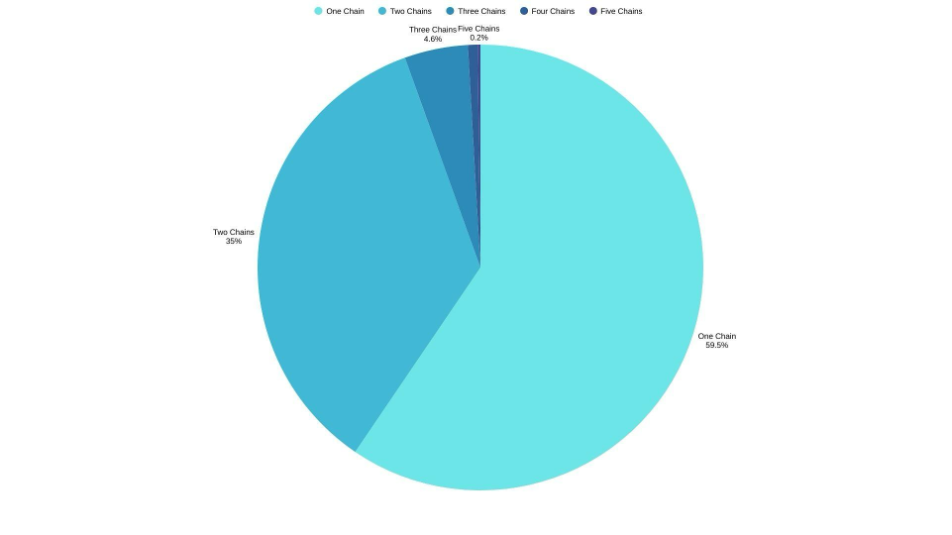

Data reveals that 59.5% of EVM wallets interact on only one network, 35% interact with just two, Only 4.4% operate across three chains, A mere 0.7% span four, and 0.2% five or more, creating a fundamental barrier to protocol growth and user discovery.

This fragmentation has far-reaching consequences:

- Protocols deployed on only a few chains miss out on users whose funds live elsewhere

- Cross-chain APR disparities emerge, even when protocols deploy across multiple chains, users may find better yields on chains where their assets don't reside

- Complicated asset management across multiple networks fragments liquidity

- Users face time-consuming processes while protocols lose potential reach

In practical terms, millions of wallets hold significant balances on one chain but cannot directly use dApps on another without the use of cumbersome bridging or swapping.

For example, Polygon, Arbitrum, and Base each have millions of active wallets, yet less-active chains have far fewer users. In this landscape, users lose time, and protocols lose reach.

Epoch targets this exact pain point. Instead of forcing developers and users to specify how to execute every step, Epoch lets them declare what they want to happen (the intent). A decentralized solver network, coordinated by Epoch’s orchestration layer, then discovers and executes the optimal multi-chain plan atomically and verifiably.

The Opportunity: Cross-Chain Intent-Centric Infrastructure

Protocol Discoverability Gap

- Base’s 38M users are invisible to Arbitrum-only protocols

- Polygon’s 18M users cannot easily reach Ethereum-native dApps

- Whales ($100k+ users) are only 9.8% but hold most of the capital

Execution Fragmentation:

Cross-chain execution today requires users to manually coordinate across isolated execution environments, each with unique gas requirements, bridge protocols, and timing constraints.

This fragmentation creates a 10-step process where a simple liquidity provision requires bridging assets, managing multiple gas tokens, calculating complex risk parameters, and executing numerous approval transactions across different chains.

Defi and Yield Disparities Across Chains

Even multi-chain protocols face discoverability limits, and APRs vary by liquidity depth across chains

Users often skip better yields or better conditions on other chains to avoid bridging friction, which results in inefficient capital allocation and missed growth.

Fundraise details

Epoch’s $1.2M raise is more than funding. It’s a signal that the industry is ready to build the coordination layer Web3 needs. With focused engineering, active partnerships, and an open testnet, Epoch aims to make cross-chain transactions through an intent-centric approach as simple and reliable as calling a single API.

For developer docs and integration guides, see Epoch Protocol Docs. Follow Epoch on X and Medium for live updates.

Try out the testnet at https://app.epochprotocol.xyz/ to experience the future of DeFi.

Contact:

Abhimanyu Shekhawat

Director

abhimanyu@epochprotocol.xyz

Disclaimer: This content is provided by Epoch. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. GlobeNewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9ee067e9-577b-4daa-8c02-d523b403303c

https://www.globenewswire.com/NewsRoom/AttachmentNg/b7e1574a-84b3-43ac-bb7f-47ee9f3fbf3a

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.